this site is not affiliated with any of brand mentioned. We may earn a commission.

- #1 Rated Online Provider of Finance and Banking Training

Unleash Your Potential. Power Your Career.

Expert-led finance and banking training and productivity tools to transform your ambition into reality.

Equip Yourself and Your Teams for Peak Performance

Master In-Demand Skills

Expert-led finance and banking training and productivity tools to transform your ambition into reality.

Learn Anywhere, Anytime

Learning that adapts to your schedule. For busy professionals & hybrid teams.

Upskill Teams at Scale

Fast-track new hire readiness, bridge skill gaps, and maximize training ROI.

Showcase Your Skills in Interviews and at Work

Build a portfolio of hands-on projects to prove your expertise and job readiness.

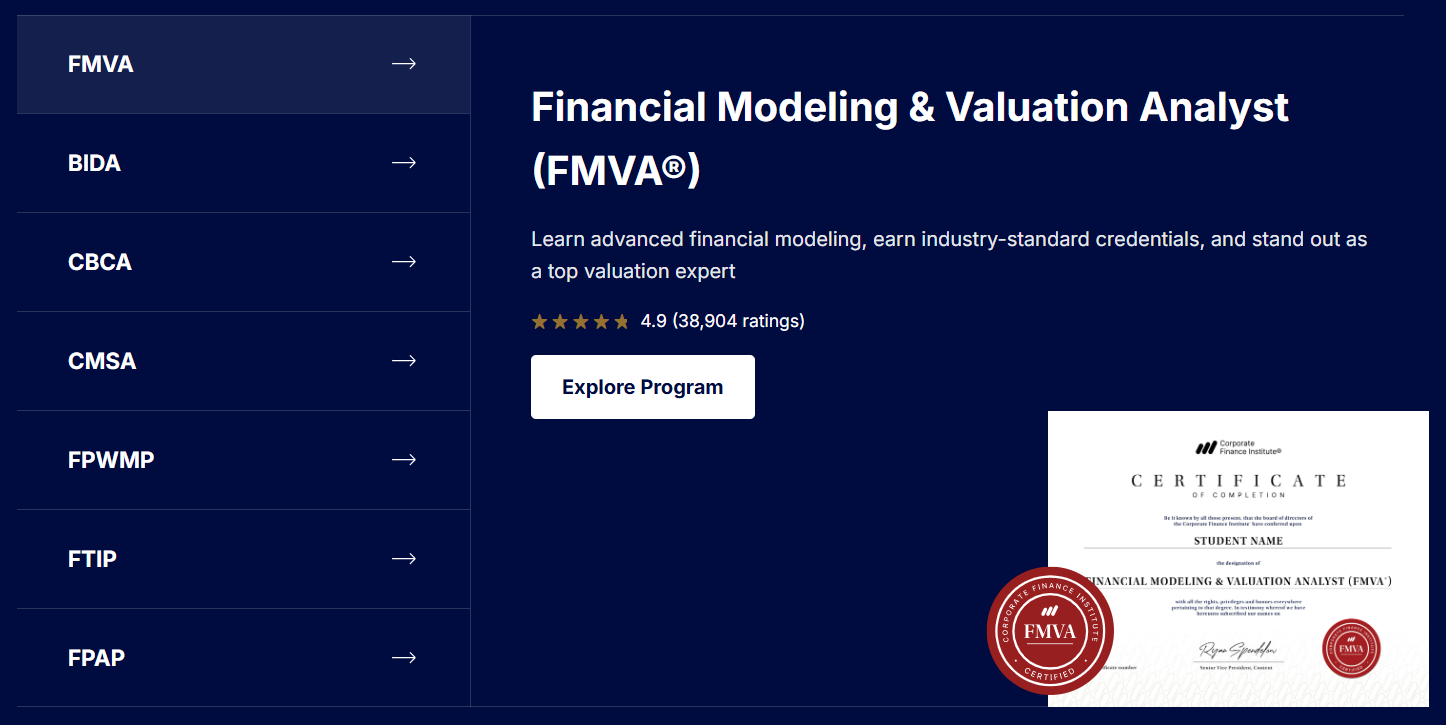

Gain Recognition Through CFI Certifications

CFI certificate programs offer a clear pathway to develop job-relevant skills and establish professional credibility. Over 85% of executives, supervisors, and HR professionals agree that certified individuals bring value, gain credibility, and are seen as top performers.

* Source

Gain Recognition Through CFI Certifications

CFI certificate programs offer a clear pathway to develop job-relevant skills and establish professional credibility. Over 85% of executives, supervisors, and HR professionals agree that certified individuals bring value, gain credibility, and are seen as top performers.

* Source

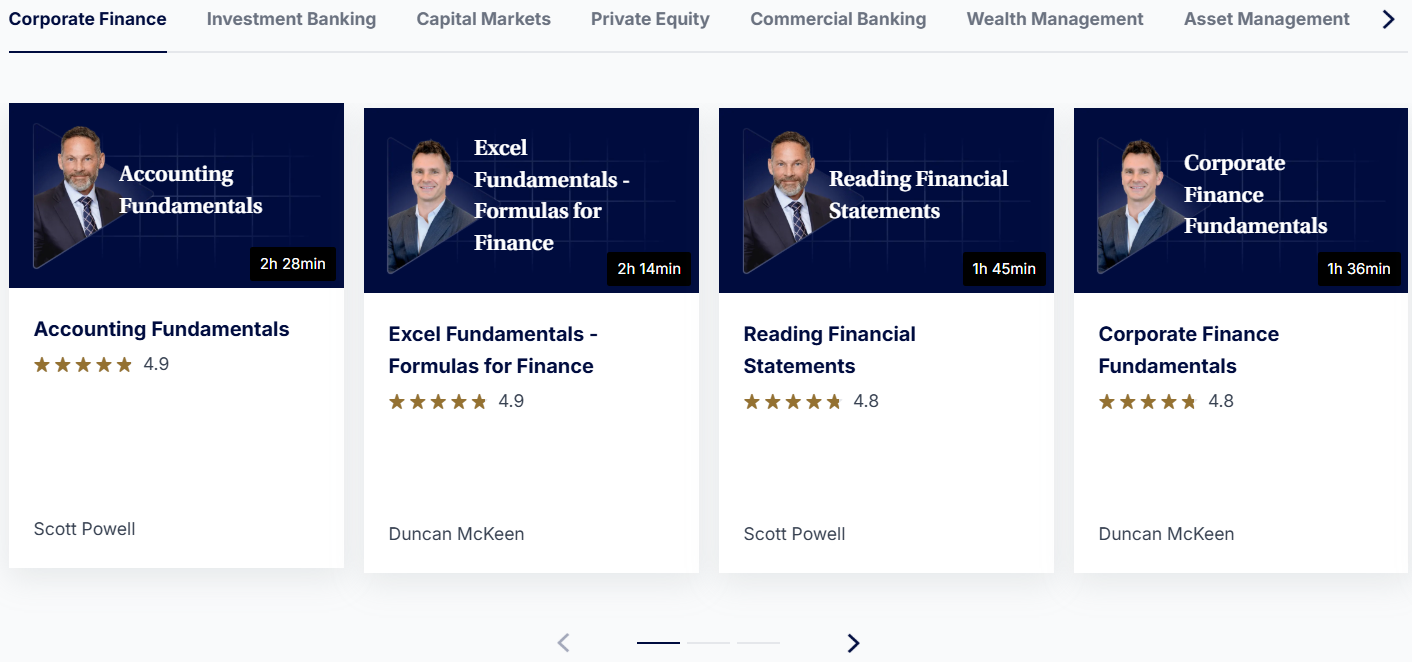

Banking and Finance Courses for All Levels

From finance fundamentals to advanced deep-dives, each course offers video lessons, practical templates, interactive exercises, skill validation, and a certificate of completion. Over 75% of CFI learners report improved productivity or competency within weeks.

Real-world Expertise from Industry Practitioners

Tim Vipond

Co-Founder & CEO

Scott Powell

Co-Founder

Duncan McKeen

EVP, Financial Modeling

Sebastian Taylor

VP, Product

Ryan Spendelow

SVP, Training & Curriculam

Beyond Training: Equipping Professional for Everyday Success

- Global Finance Community

Join a network of experts to support your learning journey, access exclusive resources, and professional development opportunities.

Company

- Abour CFI

- Meet Our Team

- Careers at CFI

- Editorial Standrads

- CPE Credits

- Learner Reviewes

- Partnerships

- Affiliates

- Students

- Newsroom

Certificates

- FMVA®

- FPAP™

- CMSA®

- CBCA®

- BIDA®

- FPWMP®

- ESG

- Leadership

- Excel

CFI For Teams

- Financial Services

- Corporate Finance

- Professional Services

- For Employers

Support

- Help | FAQ

- Legal

Company

- Member Community

- What’s New

- Resources

- Podcast

CFI

Corporate Financial Institute (CFI): Indepth Review

What Is CFI?

Corporate Finance Institute, commonly known as CFI, is a leading provider of online finance training and certifications. Headquartered in Vancouver, Canada, it was established in 2016 with the goal of bridging the gap between academic learning and real-world finance skills. Today, it has trained over a million professionals across more than 170 countries.

CFI offers a variety of programs, but it is best known for the Financial Modeling & Valuation Analyst (FMVA) certification. Other popular certifications include:

CBCA (Certified Banking & Credit Analyst)

BIDA (Business Intelligence & Data Analyst)

These programs are designed to build skills in financial modeling, business valuation, Excel proficiency, data analysis, and other in-demand areas for finance professionals.

Who Uses CFI and Why?

CFI appeals to a wide audience within the finance and business community:

University students and recent graduates who want to gain practical, job-ready skills.

Early-career professionals looking to break into investment banking, private equity, or corporate finance.

Mid-career professionals aiming to upskill, switch roles, or stand out for promotions.

Companies and teams who use CFI for training analysts, associates, and interns.

The courses are especially valuable for those seeking a cost-effective and flexible alternative to expensive MBA programs or in-person training.

What Makes CFI Stand Out?

✅ Real-World, Practical Learning

CFI emphasizes hands-on, job-focused training. Every course includes Excel-based case studies, model templates, quizzes, and exercises. You learn how to build real deliverables: DCF models, three-statement models, merger models, and more.

✅ Self-Paced, Flexible Format

All CFI courses are online and on-demand. You can start at any time and move at your own pace. This format is perfect for busy professionals and students balancing multiple commitments.

✅ Clear, Professional Presentation

CFI courses are known for their polished presentation, clear video lessons, and structured progress tracking. The instructors are industry veterans who explain concepts in an easy-to-understand, relatable way.

✅ Career-Driven Curriculum

Each certification path is structured around career goals. For example, FMVA is ideal for financial analysts, while BIDA is built for those diving into data.

What Are People Saying About CFI?

👍 Positive Reviews (Trustpilot, Reddit, YouTube)

Trustpilot (4.5/5 rating) features hundreds of positive testimonials:

“A great investment in my career.”

“Clear instruction, practical examples.”

“Helped me land a job in investment banking.”

Reddit’s r/FinancialCareers shows mixed but generally positive feedback:

“I’ve enrolled my team in FMVA. It’s a great base to build from.”

“Good for beginners or people switching from non-finance backgrounds.”

YouTube testimonials often praise the engaging videos and downloadable resources.

🚫 Constructive Criticism

Some users report auto-renewal billing issues and delayed support responses.

Others mention that CFI certifications are not as widely recognized as CFA or MBA programs.

A few users say the FMVA didn’t come up in interviews, suggesting it’s more of a supplement than a standalone credential.

Is the FMVA Certification Worth It?

The FMVA is CFI’s most popular certification and consists of:

12 core courses

3 elective courses

Final exam

It takes around 100 to 150 hours to complete and can be done over 3–6 months depending on your pace.

Key Benefits:

Gain in-demand skills like Excel modeling, valuation, budgeting, and forecasting.

Create a portfolio of templates to showcase to employers.

Receive a digital certificate and a CFI-accredited badge for LinkedIn.

FMVA holders report average salaries of $100K to $120K, though this largely depends on job location, role, and prior experience.

CFI vs. the Competition

FMVA vs. CFA

| Feature | FMVA | CFA |

|---|---|---|

| Focus | Financial modeling and valuation | Investment theory and analysis |

| Duration | 3–6 months | 2–4 years |

| Cost | $500–$847/year | ~$3,000–$5,000 total |

| Exam Format | Online, self-paced | Timed exams, fixed windows |

| Recognition | Growing | Global, established |

Bottom Line: FMVA is practical and fast; CFA is theoretical and rigorous.

FMVA vs. Wall Street Prep (WSP)

WSP offers classroom-style bootcamps and is more expensive.

CFI provides greater flexibility and better value for solo learners.

WSP is popular at investment banks; CFI is strong for corporate finance roles.

Pros and Cons

Pros

✅ Practical, job-ready skills.

✅ Downloadable templates and exercises.

✅ Self-paced learning with unlimited retakes.

✅ Strong video quality and structure.

✅ Affordable vs. traditional education.

Cons

❌ Certification name (FMVA) lacks brand weight compared to CFA.

❌ No soft-skill or networking support.

❌ Some users report auto-renewal frustrations.

❌ May not be enough alone for top-tier finance jobs.

Who Should Enroll in CFI?

CFI is best suited for:

Finance students preparing for internships or jobs.

Career switchers needing technical skills quickly.

Entry-level analysts looking to stand out.

Companies training new hires or teams.

If you’re seeking fast, structured finance skills with hands-on learning, CFI is a strong fit.

Final Verdict: Is CFI Worth It in 2025?

If your goal is to gain real-world finance skills without spending tens of thousands on a degree, CFI is absolutely worth it. Its certifications, especially FMVA, offer:

Solid foundational and advanced training in financial modeling.

Affordable pricing.

Flexibility and ease of use.

However, while CFI courses are powerful tools for learning, they do not carry the same prestige or signaling power as a CFA, MBA, or top-tier internship. So, if you’re applying for highly competitive roles, you’ll need more than just a CFI certificate.

Final score: 8.5/10.

CFI is a smart choice for practical learning, upskilling, and career transitions—but like any tool, its impact depends on how you use it.

this site is not affiliated with any of brand mentioned. We may earn a commission.